Some people are blessed with great health throughout their lives. It may be genes or healthy living or a combination of both. One wishes that for everyone one knows.

According to Statista.com, 15,7% of South Africans, or 9,8 million of the South African population, have access to private health care. It is a privilege to be able to afford private care. And those who have it, will do a lot to preserve it.

Unfortunately, a lot of people who reach retirement are shocked by the percentage of their income that goes to their medical aid. And very often they run out of benefits very soon in the year. Another shocker is medical aid inflation, which is usually a couple of percentage points higher than normal inflation.

Will they now become a burden on their children or other family members? What is the cost of a down payment at a private hospital if you don’t have medical aid? And what does special care for dementia cost per month?

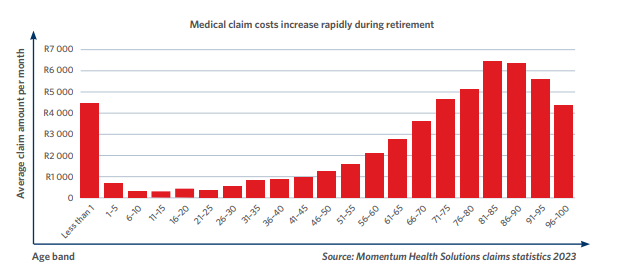

I’ve often experienced the gut reaction of people then wanting to join a cheaper medical aid, or lowering the benefits. This is ironic, as medical expenses increase during retirement. Or that is what our numbers show.

That’s why I suggest dedicated savings for medical expenses during retirement. To be the squirrel that hides acorns during summer for the coming winter.

On 30 October 2025, Daily Maverick’s Kenny Meiring also wrote: “You could set up a separate investment bucket and earmark it as your future frail-care fund.”

I like referring to extra retirement savings as “an ambulance RA”, or your “911 savings”. It’s a retirement annuity or other savings vehicle for covering those ballooning costs in a time when you just want to sit back and enjoy your life. It will rescue you when you need it. And if you never need it, what a blessing.

There are good reasons for saving extra:

- Most companies cancel medical subsidies when employees retire.

- Most chronic illnesses arise only after the age of 60.

- It is dangerous to cancel your medical aid, even for a little while, because of waiting periods and possible restricted cover when you rejoin.

- Being dependent on public clinics and hospitals can be a real challenge.

- Only a hospital plan and gap cover sound like a good idea on paper – until other challenges soar.

- You don’t want to put other assets at risk. What will you sell if something goes wrong?

- Even if you decide against the expensive treatment for a particular illness, you want to have the choice to make the decision.

The great benefits of saving in a retirement product are the tax breaks and tax-free growth you enjoy. You don’t pay tax when your money grows, and government gives you money back in your pocket for every rand you invest – at a rate equal to the tax rate you normally pay.

Go to gym, eat your greens and hold thumbs. But let’s do now what we can to avoid those too little, too late regrets.

ABOUT THE AUTHOR

Pieter Albertyn

Head of Product Solutions at Momentum Savings

Pieter is on a personal mission to empower more South Africans to be better prepared for what life throws at them.

He is a qualified actuary with over 20 years of experience spanning across pensions, risk and savings industries, in roles ranging from IT to actuarial valuations, product management and product development. He joined Momentum in 2016 and serves as the Head of Product Solutions for Momentum Investo.

Pieter completed a leadership programme with Duke University in 2021 and has a keen interest in delivering value through innovation.